Medicare Supplements in Chicago, IL

Your Trusted Medicare Supplement Advisors

Our mission is to provide you with clear, comprehensive guidance to help you make informed decisions about your healthcare coverage. Whether you're new to Medicare or looking to optimize your current plan, our team of expert consultants is here to assist you every step of the way.

Medicare Supplements in Chicago, IL

Your Trusted Medicare Supplement Advisors

Our mission is to provide you with clear, comprehensive guidance to help you make informed decisions about your healthcare coverage. Whether you're new to Medicare or looking to optimize your current plan, our team of expert consultants is here to assist you every step of the way.

Your Local Medicare Experts

As a locally-based insurance brokerage in Chicago, IL, we understand the unique healthcare needs and challenges faced by our community. Our deep roots in the area allow us to offer personalized service and expert advice tailored to your specific situation. At Leading Light Insurance Consultants, we pride ourselves on being part of the Chicago community and are dedicated to serving our neighbors with integrity and professionalism.

Local Service Areas

We proudly serve the following areas in and around Chicago:

Chicago, IL

Evanston, IL

Oak Park, IL

Cicero, IL

Berwyn, IL

Skokie, IL

Elmwood Park, IL

Maywood, IL

Forest Park, IL

River Forest, IL

Comprehensive Medicare Supplement Services

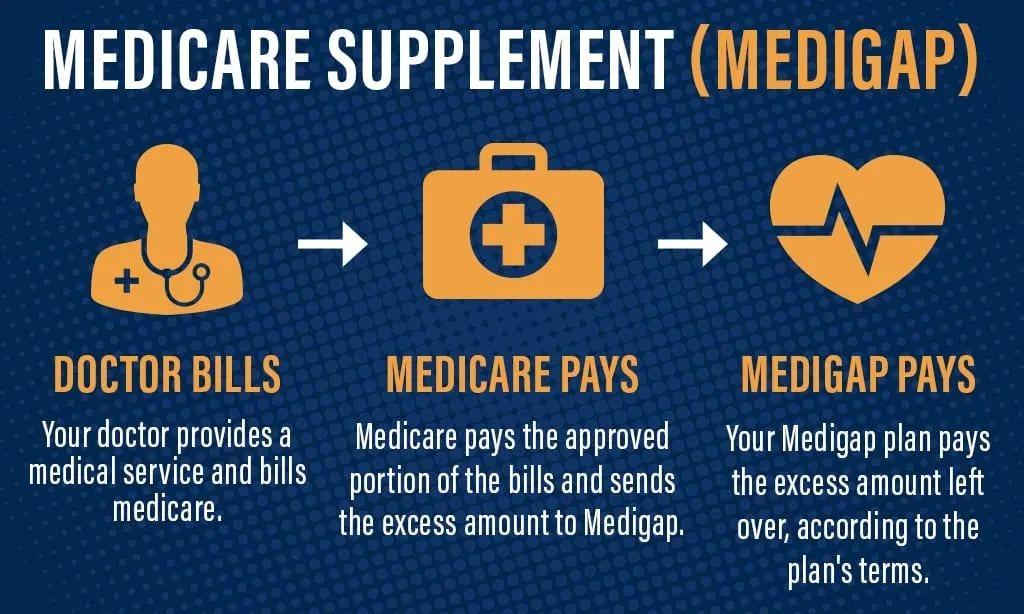

Navigating Medicare can be overwhelming, especially when it comes to choosing the right Medicare Supplement plan. Also known as Medigap, these plans are designed to cover the out-of-pocket costs that Original Medicare (Part A and Part B) doesn't, such as co-pays, coinsurance, and deductibles. Our goal is to help you understand your options and select the plan that best meets your healthcare and financial needs.

Personalized Medicare Supplement Plan Consultations

At Leading Light Insurance Consultants, we offer personalized consultations to help you evaluate your Medicare Supplement options. During our consultations, we:

Assess Your Healthcare Needs: We start by understanding your current healthcare requirements, including your preferred doctors, hospitals, and any specific medical conditions or treatments you may need.

Compare Plans: We compare various Medicare Supplement plans available in the Chicago area, focusing on key factors such as coverage benefits, premium costs, and provider networks.

Explain Benefits and Limitations: We clearly explain the benefits and limitations of each plan, ensuring you understand the financial implications and coverage details.

Annual Plan Review: We provide annual reviews of your Medicare Supplement plan to ensure it continues to meet your needs and make adjustments as necessary.

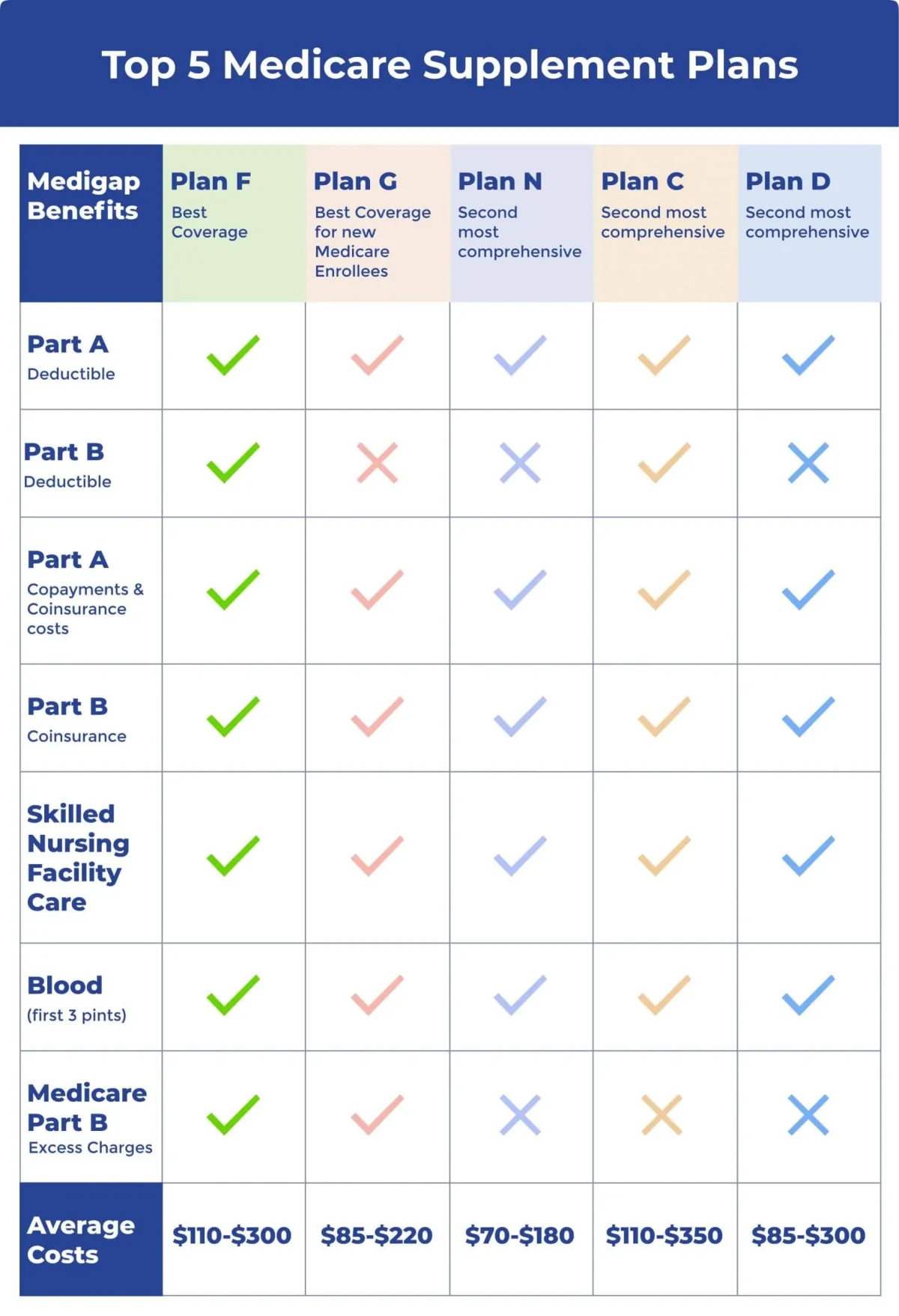

Understanding Medicare Supplement Plans

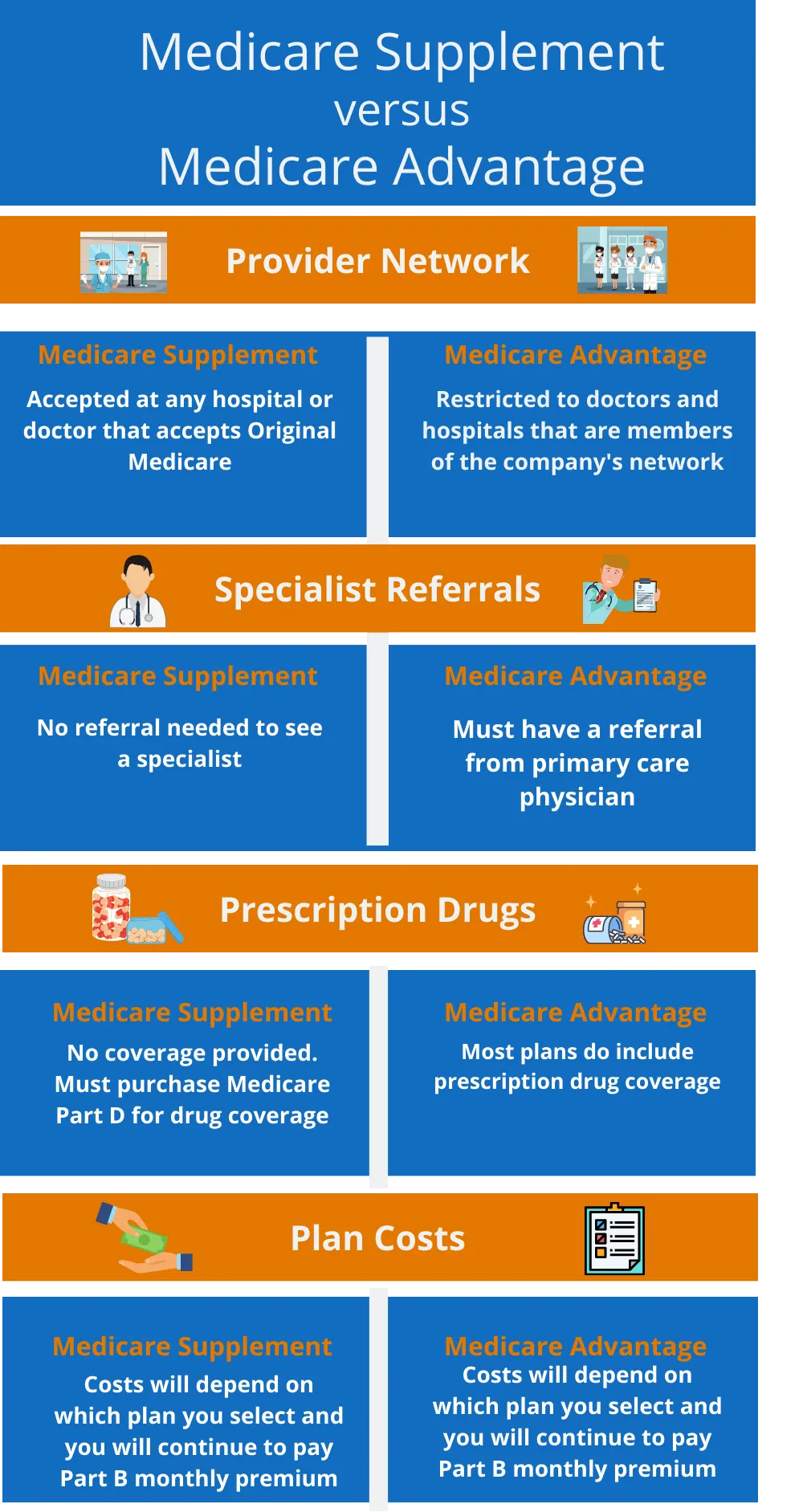

Medicare Supplement plans, also known as Medigap plans, are standardized by the federal government. This means that the basic benefits for each plan type (A, B, C, D, F, G, K, L, M, and N) are the same across all insurance companies. However, premiums can vary, and some plans may offer additional benefits. Key aspects of Medicare Supplement plans include:

Coverage for Out-of-Pocket Costs: Medigap plans cover costs such as deductibles, co-pays, and coinsurance that are not covered by Original Medicare.

Nationwide Coverage: With a Medicare Supplement plan, you have the freedom to see any doctor or specialist that accepts Medicare, anywhere in the United States.

No Network Restrictions: Unlike Medicare Advantage plans, Medigap plans do not have network restrictions, giving you the flexibility to choose your healthcare providers.

Guaranteed Renewability: As long as you pay your premiums, your Medicare Supplement plan cannot be canceled, regardless of any health issues that may arise.

The Benefits of Medicare Supplement Plans

Medicare Supplement plans offer numerous benefits that can enhance your healthcare coverage and provide peace of mind. Some of the key benefits include:

Financial Protection: By covering out-of-pocket costs, Medigap plans help protect you from unexpected medical expenses, reducing your financial risk.

Flexibility: With no network restrictions, you have the freedom to choose any doctor or hospital that accepts Medicare, ensuring you receive the care you need.

Predictable Costs: Medigap plans help make your healthcare costs more predictable, allowing you to budget for your medical expenses with greater certainty.

Guaranteed Coverage: As long as you pay your premiums, your coverage is guaranteed, providing stability and continuity in your healthcare.

Why Choose Leading Light Insurance Consultants?

Choosing the right Medicare Supplement plan can significantly impact your healthcare experience and financial well-being. At Leading Light Insurance Consultants, we are committed to providing you with the highest level of service and expertise. Here’s why you should choose us:

Independent Advisors: We are independent insurance brokers, which means we work for you, not the insurance companies. Our recommendations are based solely on your best interests.

Local Knowledge: Our team has extensive knowledge of the Chicago healthcare market, enabling us to offer tailored advice that considers local providers and resources.

Personalized Service: We take the time to understand your unique needs and provide customized solutions. Our goal is to ensure you feel confident and informed about your Medicare Supplement choices.

Ongoing Support: Our relationship with you doesn’t end once you select a plan. We offer ongoing support, including annual reviews and assistance with any issues that may arise.

Our Commitment to You

At Leading Light Insurance, our commitment goes beyond helping you choose the right plan. We strive to build lasting relationships with our clients, offering continuous support and guidance throughout your insurance journey. Our dedicated team is here to assist you with any questions or concerns, ensuring you always have the best coverage for your needs.

Contact Us Today

Ready to find the perfect insurance coverage? Contact Leading Light Insurance today for a free consultation. Our team is here to answer your questions, provide expert advice, and help you secure the insurance coverage you need.

Common Questions and Concerns

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage with the added benefit of building cash value. Term policies are generally more affordable, whereas whole life policies are more expensive but offer investment opportunities and permanent coverage.

How much life insurance coverage do I need?

The amount of coverage you need depends on various factors, including your financial obligations, income, debts, and future goals. Our consultants can help you evaluate your needs and recommend the appropriate coverage amount.

Can I change my life insurance policy later?

Yes, certain types of life insurance, like universal life insurance, offer flexibility to adjust coverage and premiums as your financial situation changes. It's essential to review your policy regularly to ensure it still meets your needs.

What factors affect life insurance premiums?

Life insurance premiums are influenced by factors such as age, health, lifestyle, and the type of policy you choose. Our team can help you understand how these factors impact your premiums and find ways to secure the best rates.

Is life insurance necessary if I have no dependents?

Life insurance can still be valuable even if you have no dependents, as it can cover end-of-life expenses, pay off debts, and leave a legacy. Additionally, purchasing a policy when you are young and healthy can secure lower premiums for future coverage needs.

Email: [email protected]

Phone: (708) 905-9603

Address Office: 4036 South Oakenwald Avenue, Chicago IL 60653