CONTACT Leading Light Insurance Consultants

At Leading Light Insurance Consultants, we are dedicated to providing exceptional service and personalized insurance solutions to meet your needs. Whether you're looking to understand your Medicare options, explore life insurance policies, or find affordable health insurance, our team of experts is here to help. Our goal is to make the process as seamless and informative as possible, ensuring you have the coverage you need for peace of mind.

Get in Touch Today

If you’re ready to explore your insurance options or have any questions, don’t hesitate to contact us. Our team at Leading Light Insurance Consultants is here to help you navigate the complexities of Medicare, life, and health insurance. Reach out to us today for a free consultation and let us guide you to the best insurance solutions for your needs.

How to Reach Us

Phone

Give us a call at (708) 905-9603. Our knowledgeable team is available to assist you during our business hours, which are Monday through Friday from 9:00 AM to 5:00 PM CST. Whether you have questions about Medicare Advantage Plans, Medicare Supplements, Life Insurance, or Health Insurance, we are just a phone call away.

Feel free to send us an email [email protected]. We strive to respond to all email inquiries within one business day. Please provide as much detail as possible about your inquiry so we can offer the most accurate and helpful information.

Online Contact Form

For your convenience, we also offer an online contact form. Simply fill out the form with your name, email address, phone number, and a brief message detailing your inquiry. One of our representatives will get back to you promptly to address your concerns and provide the information you need.

Schedule a Free Consultation

We understand that choosing the right insurance plan can be daunting. That’s why we offer free, no-obligation consultations to help you navigate your options. During your consultation, we will:

Evaluate your individual healthcare needs.

Explain the differences between Medicare Part A and Part B.

Compare Medicare Advantage Plans and Original Medicare.

Discuss the benefits of Medicare Supplements.

Explore life insurance policies and health insurance options.

Common Questions and Concerns

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage with the added benefit of building cash value. Term policies are generally more affordable, whereas whole life policies are more expensive but offer investment opportunities and permanent coverage.

How much life insurance coverage do I need?

The amount of coverage you need depends on various factors, including your financial obligations, income, debts, and future goals. Our consultants can help you evaluate your needs and recommend the appropriate coverage amount.

Can I change my life insurance policy later?

Yes, certain types of life insurance, like universal life insurance, offer flexibility to adjust coverage and premiums as your financial situation changes. It's essential to review your policy regularly to ensure it still meets your needs.

What factors affect life insurance premiums?

Life insurance premiums are influenced by factors such as age, health, lifestyle, and the type of policy you choose. Our team can help you understand how these factors impact your premiums and find ways to secure the best rates.

Is life insurance necessary if I have no dependents?

Life insurance can still be valuable even if you have no dependents, as it can cover end-of-life expenses, pay off debts, and leave a legacy. Additionally, purchasing a policy when you are young and healthy can secure lower premiums for future coverage needs.

Email: [email protected]

Phone: (708) 905-9603

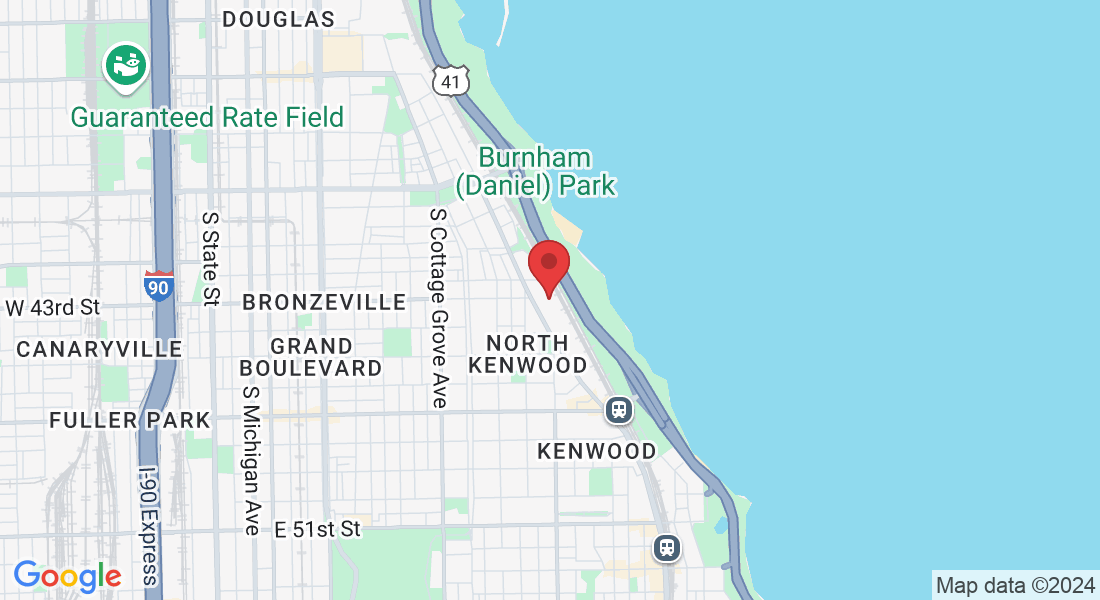

Address Office: 4036 South Oakenwald Avenue, Chicago IL 60653