Leading Light Insurance Consultants

Your Guide to Medicare Advantage Plans in Chicago, IL

Welcome to Leading Light Insurance, your trusted independent insurance brokers in Chicago, IL. We specialize in helping you navigate your Medicare and retirement needs with a focus on Medicare Advantage Plans, Medicare Supplements, Life Insurance, and Health Insurance.

Welcome to Leading Lights Insurance, your trusted independent insurance brokers in Chicago, IL. We specialize in helping you navigate your Medicare and retirement needs with a focus on Medicare Advantage Plans, Medicare Supplements, Life Insurance, and Health Insurance.

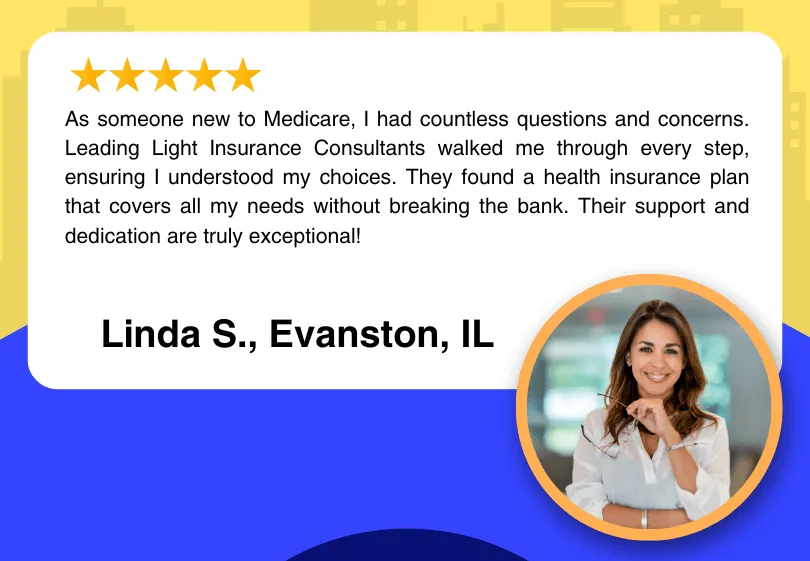

What Our Clients Are Saying

What Our Clients Are Saying

Your Trusted Insurance Consultant

At Leading Light Insurance, we specialize in helping you navigate the complexities of Medicare to find the best coverage options tailored to your individual healthcare needs. Our mission is to provide clear, comprehensive guidance on the key differences between Medicare Advantage plans and Original Medicare, ensuring you make informed decisions that protect your health and financial well-being.

What We Do For You

Evaluate Your Healthcare Needs: We assess your individual needs before you choose between Medicare Part A, Part B, or a Medicare Advantage Plan.

Clarify Medicare Options: We explain the differences between Medicare Part A and Part B, emphasizing the freedom of choice with Original Medicare.

Compare Plans: We research and compare Medicare Advantage plans and Original Medicare to find the best fit for your healthcare needs.

Highlight Plan Implications: We explain the potential loss of unique benefits when switching from Original Medicare to a Medicare Advantage plan.

Quality Evaluation: We evaluate Medicare Advantage plans based on star ratings to ensure quality service.

Annual Reviews: We review your Medicare Advantage plan details annually during enrollment periods to ensure your coverage remains aligned with your needs.

Future Planning: We stress the importance of selecting the right plan from the start to avoid future limitations.

Inflation Impact: We explain how inflation can affect Medicare supplement plans by increasing premiums over time.

Informed Decisions: We help you understand the details of Medicare Advantage plans to make informed choices.

Who We Are

Leading Light Insurance is a team of independent insurance brokers dedicated to helping people with their Medicare and retirement needs. We represent our clients' best interests, not those of an insurance company. Best of all, our services are free to you, the consumer. All you need to do is ask, and we're here to provide the information you need to decide if a Medicare Advantage Plan or a Medicare Supplement is right for you.

Choosing the right insurance plan can be challenging, but with Leading Light Insurance, you have a trusted partner by your side. Our expertise in Medicare Advantage Plans, Medicare Supplements, Life Insurance, and Health Insurance ensures that you get the best coverage tailored to your unique needs. Serving the Chicago, IL area, we're committed to providing personalized, local service. Contact us today and let us guide you through the insurance maze with ease and confidence.

We provide the best insurance consultation services in Chicago, IL

Navigating Medicare and other insurance options can be daunting. That's why Leading Light Insurance offers comprehensive consulting services to help you make informed decisions. Our goal is to ensure you have the right coverage at the right price.

Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, offer an alternative to...

Medicare Supplements

Medicare Supplements, or Medigap plans, are designed to cover the out-of-pocket costs that...

Life Insurance

Life insurance is a crucial component of a comprehensive financial plan, providing financial security for...

Health Insurance

Health insurance is vital for protecting yourself against unexpected medical expenses and ensuring access to...

OUR SERVICES

Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, offer an alternative to Original Medicare by providing all your Part A and Part B coverage through private insurance companies. These plans often include additional benefits like dental, vision, and hearing coverage, and many come with low or even $0 monthly premiums. However, it's essential to understand that these plans come with network restrictions and potential out-of-pocket costs, such as co-pays and deductibles.

When considering a Medicare Advantage Plan, it's crucial to evaluate:

Provider Networks: Ensure your preferred doctors and hospitals are included in the plan's network.

Out-of-Pocket Costs: Understand the maximum out-of-pocket limits, which can help protect you from significant financial risks.

Additional Benefits: Compare the extra benefits offered by different plans to find the best match for your healthcare needs.

Medicare Supplements

Medicare Supplements, or Medigap plans, are designed to cover the out-of-pocket costs that Original Medicare doesn't, such as co-pays, coinsurance, and deductibles. These plans provide peace of mind by limiting your financial exposure and allowing you to see any doctor that accepts Medicare, without the need for referrals or network restrictions.

Key advantages of Medicare Supplement plans include:

Comprehensive Coverage: Minimize your out-of-pocket expenses by covering gaps left by Original Medicare.

Flexibility: Freedom to choose any healthcare provider that accepts Medicare.

Standardized Benefits: Guaranteed coverage consistency, as benefits are standardized by the government across all insurance companies.

Life Insurance

Life insurance is a crucial component of a comprehensive financial plan, providing financial security for your loved ones in the event of your passing. At Leading Light Insurance Consultants, we offer a variety of life insurance policies tailored to meet your unique needs, including term life, whole life, and universal life insurance.

When choosing a life insurance policy, consider the following:

Coverage Amount: Determine how much coverage you need to support your family's financial needs.

Policy Type: Understand the differences between term, whole, and universal life insurance to choose the best option for your situation.

Affordability: Find a policy that fits within your budget without compromising on the necessary coverage.

Health Insurance

Health insurance is vital for protecting yourself against unexpected medical expenses and ensuring access to necessary healthcare services. Whether you need coverage for yourself or your entire family, we offer a range of health insurance plans designed to meet various needs and budgets.

Important factors to consider when selecting a health insurance plan include:

Premiums: Balance the monthly premium costs with the benefits provided by the plan.

Coverage Options: Ensure the plan covers essential health benefits and any specific services you may require.

Network Providers: Check if your preferred doctors and healthcare facilities are included in the plan's network.

OUR SERVICES

Medicare Advantage Plans

Medicare Advantage Plans, also known as Medicare Part C, offer an alternative to Original Medicare by providing all your Part A and Part B coverage through private insurance companies. These plans often include additional benefits like dental, vision, and hearing coverage, and many come with low or even $0 monthly premiums. However, it's essential to understand that these plans come with network restrictions and potential out-of-pocket costs, such as co-pays and deductibles.

When considering a Medicare Advantage Plan, it's crucial to evaluate:

Provider Networks: Ensure your preferred doctors and hospitals are included in the plan's network.

Out-of-Pocket Costs: Understand the maximum out-of-pocket limits, which can help protect you from significant financial risks.

Additional Benefits: Compare the extra benefits offered by different plans to find the best match for your healthcare needs.

Medicare Supplements

Medicare Supplements, or Medigap plans, are designed to cover the out-of-pocket costs that Original Medicare doesn't, such as co-pays, coinsurance, and deductibles. These plans provide peace of mind by limiting your financial exposure and allowing you to see any doctor that accepts Medicare, without the need for referrals or network restrictions.

Key advantages of Medicare Supplement plans include:

Comprehensive Coverage: Minimize your out-of-pocket expenses by covering gaps left by Original Medicare.

Flexibility: Freedom to choose any healthcare provider that accepts Medicare.

Standardized Benefits: Guaranteed coverage consistency, as benefits are standardized by the government across all insurance companies.

Life Insurance

Life insurance is a crucial component of a comprehensive financial plan, providing financial security for your loved ones in the event of your passing. At Leading Light Insurance Consultants, we offer a variety of life insurance policies tailored to meet your unique needs, including term life, whole life, and universal life insurance.

When choosing a life insurance policy, consider the following:

Coverage Amount: Determine how much coverage you need to support your family's financial needs.

Policy Type: Understand the differences between term, whole, and universal life insurance to choose the best option for your situation.

Affordability: Find a policy that fits within your budget without compromising on the necessary coverage.

Health Insurance

Health insurance is vital for protecting yourself against unexpected medical expenses and ensuring access to necessary healthcare services. Whether you need coverage for yourself or your entire family, we offer a range of health insurance plans designed to meet various needs and budgets.

Important factors to consider when selecting a health insurance plan include:

Premiums: Balance the monthly premium costs with the benefits provided by the plan.

Coverage Options: Ensure the plan covers essential health benefits and any specific services you may require.

Network Providers: Check if your preferred doctors and healthcare facilities are included in the plan's network.

OVERVIEW ABOUT MEDICARE IN CHICAGO, IL

Original Medicare

Original Medicare consists of Medicare Part A and Part B. It's the foundation of Medicare and offers essential coverage for various medical services.

Medicare Part A

Medicare Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services. Most people do not pay a premium for Part A because they or their spouse paid Medicare taxes while working.

Medicare Part B

Medicare Part B covers outpatient care, preventive services, ambulance services, and durable medical equipment. Part B requires a monthly premium, which varies based on your income.

The Two Greatest Benefits of Original Medicare

Access to a Broad Network of Providers: With Original Medicare, you can see any doctor in the United States or its territories as long as they accept Medicare. This means over 98% of doctors are available to you, providing unparalleled access to care.

Medicare’s Non-Interference with Your Care: Medicare is designed to cover everything that is medically necessary, with no insurance company interfering with your treatment decisions. You don’t need approval to seek a specialist or a second opinion.

Choosing the Right Medicare Plan

Once you sign up for Medicare Part B, you have three main options to consider:

Option 1: Original Medicare with Prescription Drug Coverage

You can choose to keep Original Medicare (Part A and Part B) and add prescription drug coverage through a Medicare Part D plan. However, relying solely on Original Medicare can leave you exposed to high out-of-pocket costs, as there are no maximum out-of-pocket limits on your financial risk.

Option 2: Medicare Advantage Plan

Medicare Advantage Plans (Part C) offer an alternative to Original Medicare. These plans are provided by private insurance companies and must follow Medicare rules. They often include additional benefits such as vision, dental, and hearing coverage.

Key Features of Medicare Advantage Plans

Network Restrictions: You may need to use doctors and hospitals within the plan’s network.

Out-of-Pocket Limits: Medicare Advantage Plans have a maximum out-of-pocket limit, protecting you from catastrophic healthcare expenses.

Low or No Premiums: Many Medicare Advantage Plans have low or no monthly premiums in addition to the Part B premium.

Option 3: Original Medicare with a Medicare Supplement Plan

A Medicare Supplement Plan (Medigap) works alongside Original Medicare to cover out-of-pocket costs like copayments, coinsurance, and deductibles. This option provides more predictable costs and broader access to healthcare providers.

Key Features of Medicare Supplement Plans

Standardized Benefits: Benefits are standardized by the government, meaning Plan G from one insurer offers the same coverage as Plan G from another.

Predictable Costs: Medigap plans help limit your out-of-pocket expenses, providing financial peace of mind.

No Network Restrictions: You can see any doctor who accepts Medicare, giving you flexibility and choice in your healthcare providers.

Benefits of Choosing Leading Light Insurance

Choosing the right insurance can protect you from unexpected financial burdens and provide peace of mind. Here are some benefits of working with us:

Comprehensive Coverage Options: From Medicare to life and health insurance, we cover all your needs.

Local Expertise: Our deep knowledge of the Chicago, IL area ensures that we can provide relevant and effective advice.

Ongoing Support: We’re here to help you not only at the time of enrollment but throughout the life of your policy.

Personalized Service: We understand that every individual and family has unique needs. Our personalized approach ensures you get the best coverage tailored to your situation.

Cost Savings: Our independent status allows us to compare multiple plans and find the most cost-effective solutions for you.

Our Commitment to You

At Leading Light Insurance, our commitment goes beyond helping you choose the right plan. We strive to build lasting relationships with our clients, offering continuous support and guidance throughout your insurance journey. Our dedicated team is here to assist you with any questions or concerns, ensuring you always have the best coverage for your needs.

Contact Us Today

Ready to find the perfect insurance coverage? Contact Leading Light Insurance today for a free consultation. Our team is here to answer your questions, provide expert advice, and help you secure the insurance coverage you need.

Common Questions and Concerns

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage with the added benefit of building cash value. Term policies are generally more affordable, whereas whole life policies are more expensive but offer investment opportunities and permanent coverage.

How much life insurance coverage do I need?

The amount of coverage you need depends on various factors, including your financial obligations, income, debts, and future goals. Our consultants can help you evaluate your needs and recommend the appropriate coverage amount.

Can I change my life insurance policy later?

Yes, certain types of life insurance, like universal life insurance, offer flexibility to adjust coverage and premiums as your financial situation changes. It's essential to review your policy regularly to ensure it still meets your needs.

What factors affect life insurance premiums?

Life insurance premiums are influenced by factors such as age, health, lifestyle, and the type of policy you choose. Our team can help you understand how these factors impact your premiums and find ways to secure the best rates.

Is life insurance necessary if I have no dependents?

Life insurance can still be valuable even if you have no dependents, as it can cover end-of-life expenses, pay off debts, and leave a legacy. Additionally, purchasing a policy when you are young and healthy can secure lower premiums for future coverage needs.

Email: [email protected]

Phone: (708) 905-9603

Address Office: 4036 South Oakenwald Avenue, Chicago IL 60653